There are always opportunities in the stock market for catching a major move and trend trading that market for years.

Just as there is always a raging bull or bear market somewhere, there is also always a wildly hot stock that dramatically outperforms the market indexes for years and years.

Although I’m primarily a technical analyst, I do use some fundamental data from time to time as well.

One of my favorite ways of finding the next “hot stock” is to look for a company that is becoming part of the culture, similar to an approach used by Peter Lynch.

What I mean by that is a company that provides a product or service that is not only popular and liked and sells well, but it actually becomes ingrained into our culture itself.

Examples:

- Remember when fast food first began to surface? Soon we had a McDonald’s in every city … and then we started seeing McDonald’s every mile in the city!

- The same thing happened with Starbucks, except to an even greater extent in some areas where you would have more than one Starbucks coffee houses within a block or two!

- Of course we all know about the ever-present i-pod from Apple.

- And hardly anyone today logs onto the Internet without using Google in one way or another.

- Oh, and remember when eBay swept the nation … and world?

Of course hindsight is 20/20 and everyone can look back at those companies and wish they were on board with them early.

But here’s the great thing about looking for these types of companies that become part of our culture: You don’t have to buy them early before anyone else does. When a company becomes part of our culture, it often has long-term staying power for years and years.

Of course all investing and trading is risky. There are no guarantees. Some companies may release a product that the culture clings to, but then fall out of favor due to negative news, faulty manufacturing, law suites, etc.

Also along the way, even those that enjoy long term success have their ups and downs like any other.

Of course all good things must come to an end. Competition enters, technology and tastes change, and what was so central to the culture in the past can seem old fashioned in the not so distant future.

Therefore even with this approach, it’s critical to learn how to read charts so you can understand what is going on in any stock and how the market participants are treating it.

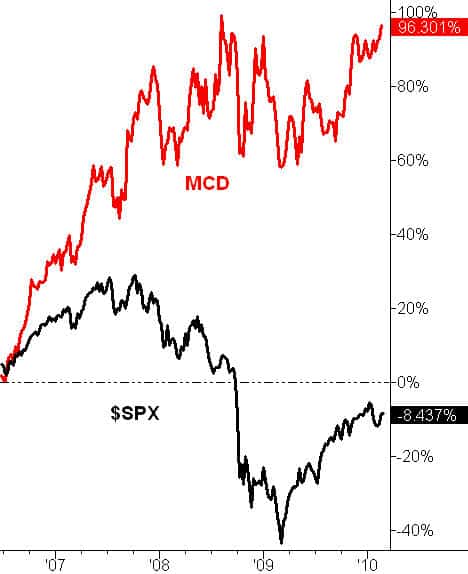

Below are some examples of stocks with products that became part of our culture. These charts are percentage change charts over the last 5 years. I’ve also plotted the S&P 500 on the chart (the black line) so you can see if the stock outperformed the index.

——-

McDonalds (MCD) has been a major part of the American culture for a long time, and they have spread internationally as well. Here is a stock that continues to out perform the S&P even after all these years. It has shown a lot of staying power!

——-

Google (GOOG) is one of the most influential and powerful companies in the world. As the Internet has emerged to dominate our lives, Google has emerged to dominate the Internet.

——-

Apple (AAPL) has shown amazing staying power and creativity. While they did not fair well in the battle of the operating systems against Microsoft, they came back aggressively with the i-Pod and i-Phone that have taken the US by storm … and it’s stock has taken the market by storm.

——-

Starbucks (SBUX) is everywhere! This omnipresence of Starbucks is so well-known that it is often the brunt of jokes on TV and in movies that show 2 Starbucks on the same block or directly across the street from each other. While this is definitely a company that has become part of our culture, its 5-year track record has not been as impressive as the 3 previous companies.

E-Bay (EBAY) was a cultural phenomena that changed the way people operated online, bought products, and made money for themselves. It was a Wall Street darling for a long time. I still remember the day that turned (yes, it was one day) and it never fully regained it’s luster with investors. This is a reminder that even stocks that become part of our very culture, can still take big hits (trading and investing is very risky) and that we need to always use protective strategies in our investing.

——-

——-

(these relative strength charts measure percent move

in the last 5 years – the relative strength of these

stocks to the S&P looks dramatically different

when measured over different times)

——-

So here’s the big question:

“How do we find the next “hot stock” that will become part of our culture?

There is no sure-fire way to do that, but here are some things to consider:

- Look around the environment. Is there a company that is buying up real estate and establishing a dominant physical presence that is just starting to become obvious, like McDonalds and Starbucks did?

- Read magazines and newspapers that publish cultural trends.

- Ask your teenager! He or she will probably know what is hot before you do!

Remember, you don’t need to catch these companies before they are successful and visible. The trends of these companies can last a long, long time. On the other hand, I still like to use hedging strategies to protect myself.

The way I use the relative strength charts above and also the techniques I use to hedge my positions are detailed in my Swing Trading Course.

Now let’s have some fun …

What do you think of this as one possible approach to investing? Post your comment and let us know!

thanks for your generosity Dr Burns !

I love the idea about asking a teenager,

that is way better then any approach I coulf

think of …

all the best

james

Good article

Very useful info.

I trade stocks every day and seldom keep a stock overnight. I leaned that lesson from some good stocks that are sitting in my account with little or no movement toward the original investment price. Pick a trend, buy or short then clear it out when/if it moves into a profit day or take a small hit by the end of the trading day. There is always another day. Charts and news do help with selections.

Cheers,

Joe

Cheers,

Joe

Thanks for another informative message.

Hi Barry,

Always on the lookout for great trading ideas. Certainly worth considering. Sounds similar to Peter Lynch’s approach and we all know how that worked out for him and his investors.

I am new at it, done the SITM 2 day course, had a go at some trades, got in none so far but at least did not lose any money, but I think I may buy your course, it could change my chances at making some money. Need it badly, sick of being broke

Hi Barry,

This is the technique that John Lynch wrote about in “One Up on Wall Street” more than 20 years ago. It obviously still works!

Thanks Barry, I always enjoy your posts. I once bought a 1000 shares of TASR when it was under a dollar for the same reasons. I got impatient and sold it for about a dollar and it went off like a rocket, It could have me very well off. I should have done your courses way back then and saved myself a fortune lol.

Thanks Barry, Always useful stuff from you. Your courses have more than paid for themselves. Tend to go back to them regularly as I seem to be lured off to other techniques and subtlety become confused and have to come back to your basics.

Hi Barry

How would you stay in a trend like some of those mentioned using T/A ?

Is that why they say there are no rich chartists ?

Thanks for article.

Google will own the world one day.

(they know what we search for !!!)

Dr. Burns,

Nice, very nice.

A practical, logical view that can be applied to not only stocks and the markets but to life itself. The bottom line, stay informed and seek out information from credible sources that have direct involvement in the sector or are already using the products.

Keep the analysis coming.

Thanks

Dale

Well, that’s a solid approach.

Hi Barry,

Well done.

As we have a growing worldwide elderly population, anything related to the elderly market should do well.

Also online education, or distance learning should be a good growth area.

Wave power, wind turbines and clean coal should do well too.

There must be many others.

Geoffrey Salvage

Thanks Barry, I always enjoy your posts.

Dito dennise….

Keep the analysis coming

Its gotta be Goldman Sachs for me then 🙂

Nice.

Yea, life happens at the right edge of the screen so even long term fundamental positions carry the same (or more) uncertainty as a short swing trade.

My money is on Nano, bio, and new electrectonics.

As far as the no rich chartists remark. Look up Dan Zanger. Gaining wealth at trading is about discipline, consistancy, timing and luck. The same as any other method.

Another wise man from the finance world once shared those very same findings and in fact, wrote a book or two that described it in great detail…the man who was behind the meteoric rise of one of the world’s best known mutual fun: The Magellan Fund…the man as most will know, is Peter Lynch..kudos for reminding us that this kind of “research” does pay off.

Thanks for all of your ongoing work Barry, great stuff, keep it up.

As for the derogatory comment regarding chartists, what a stupid, arrogant thing to say. Both TA & FA have their merits. That said, reading the tea leaves and turning a blind eye to technicals didn’t help you much Sep 08 now did it matey??

Dr. Barry,

Good article. Some past stocks that did good for me were Home Depot and Block Buster. As I saw them popping up all over Atlanta, I got in at an early stage and they paid off well.

I’m waiting for a good electric car and thinking the battery manufacturer may be a great play off of it.

More good stuff, thanks Dr. I personally like trend tradding so I’ll stick to that. The odds are a lot better for me.

TJ mentions “tred trading” as his personal like…but from what I read; understand; and have spoken to other “gurus” about, is that there is a low probability of a trend developing and lasting more then 25% of the time…not sure if those odds are better?..perhaps vs. the next great company coming to market, they could be…Would love to hear Barry weigh in on this issue.

Hi Barry,

This is a great suggestion. It made me go and look at NetFlix (NFLX)and I was suprised to see how well it has done given the down/just creeping up that other stocks are doing right now.

I’ve noticed NFLX before but, wasn’t giving it so much attention. Now I will and I will be scanning the horizon for other such stocks.

Thanks for your wonderful wisdom!

Michael

Enjoyed your article. How true-How true and do not forget that teenager.

David